BI & Analytics

Turn Transaction Data

Into Strategic Insight

Card transactions are your richest behavioral dataset — if you can actually read them.

The Analytics Problem

No One Talks About

Banksinvest millions in BI, CRM, and customer analytics. But the foundation isbroken.

Why Current Transaction Data Fails:

- Merchant names are cryptic terminal strings

- Categories are wrong or meaningless

- Customer segments are built on guesswork, not actual behavior

You have the data. You just can't use it.

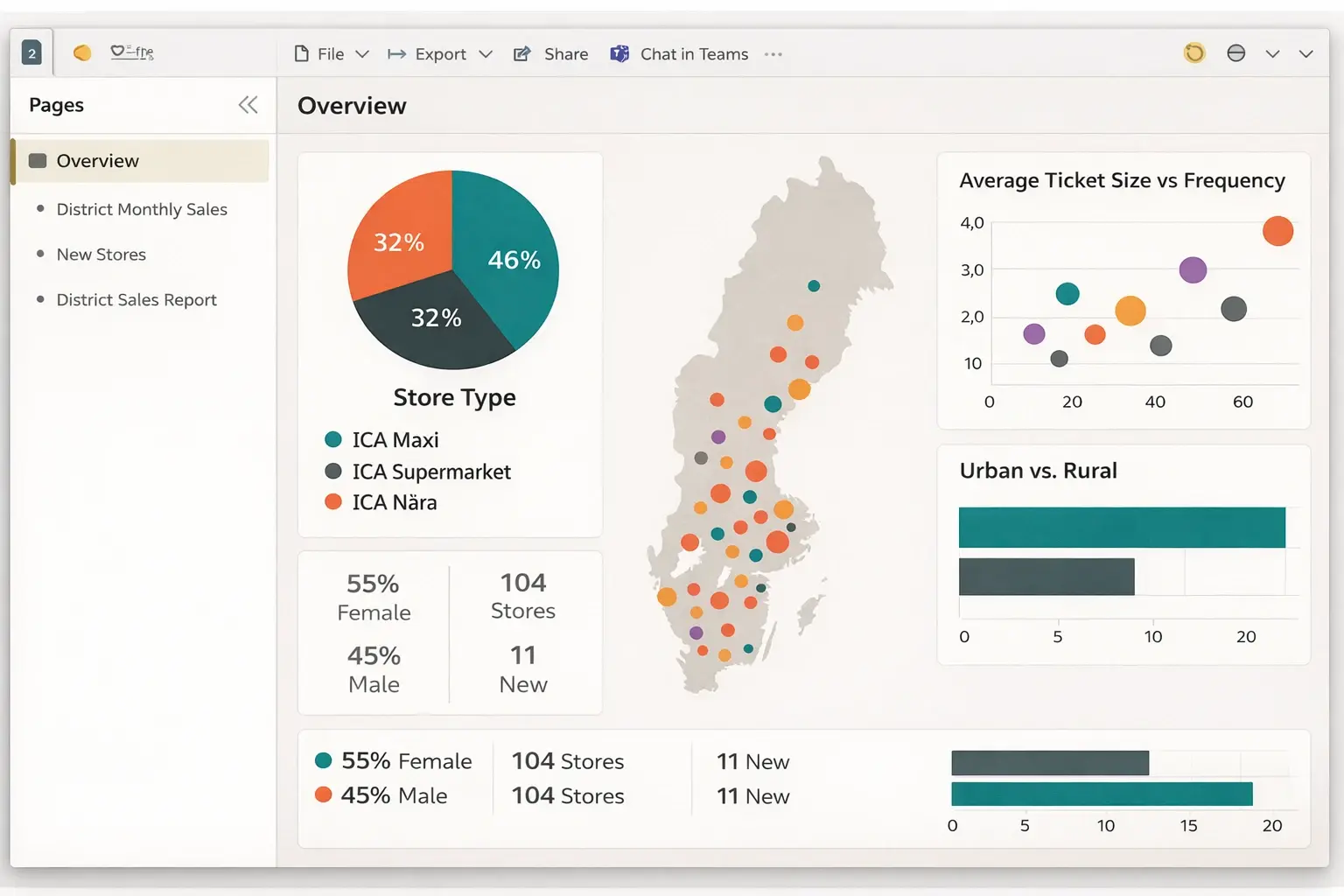

What Becomes Possible With Clean Data

When every transaction has the correct merchant name, category, and metadata, your entire analytics capability transforms.

Suddenly you can detect life events in real time, spot churn signals early, and segment customers based on actual spending — not proxies or external data you're paying for.

The Next Banking Standard.

Built early by a few.

Discover how enriched transaction data unlocks better models, sharper segmentation, and new revenue opportunities while reducing external data costs.

Why Unwrap?

Nordic focus. Built for Nordic banks, supporting local languages and merchants that matter to your customers.

Fast integration. Works within your existing infrastructure via API or file flows.

Immediate impact. Use in mobile apps, customer service tools, and BI environments from day one.

%20(2).png?width=553&height=148&name=image%20(5)%20(2).png)